BANKING & FINANCE

Smarter Compliance & Risk Control for Banking & Finance

Faster onboarding, automated monitoring and full KYC/AML coverage – all powered by Nordic data.

Built for Regulatory Demands – and Business Growth

Automated Risk Assessment

Ensure proactive regulatory compliance and minimize risks by responding quickly to warning signals.

Operating in Multiple Markets

Access quality-assured data across the Nordics – for confident decisions in every market.

From Onboarding to Monitoring

Automate your AML and compliance processes – from KYC and KYB to ODD and ad hoc checks.

Master Data Management

Access relevant data and synchronize it with your internal systems.

Built for Banking and Finance - From AML Managers to KYC Officers

See how we solve your most common challenges with smooth, automated flows.

AML Managers

The Problem

Slow, manual reviews.

How Roaring Helps

Continuous risk analysis & automated alerts.

Risk Managers

Common Challenge

Risk classification from an AML and business perspective

How Roaring Helps

The right data at the right time at via Risk API and Monitoring.

Product owners

The Problem

Complex integrations are time-consuming.

How Roaring Helps

Quick setup with clear documentation and standardized APIs.

Kyc OFFICERS

Common Challenge

Slow, manual reviews

How Roaring Helps

Automated KYC workflows.

Compliance Managers

The Problem

Regulatory compliance is time-consuming.

How Roaring Helps

Automated AML and onboarding processes via APIs.

Want To Learn More?

Ensure compliance throughout the entire customer lifecycle with Roaring

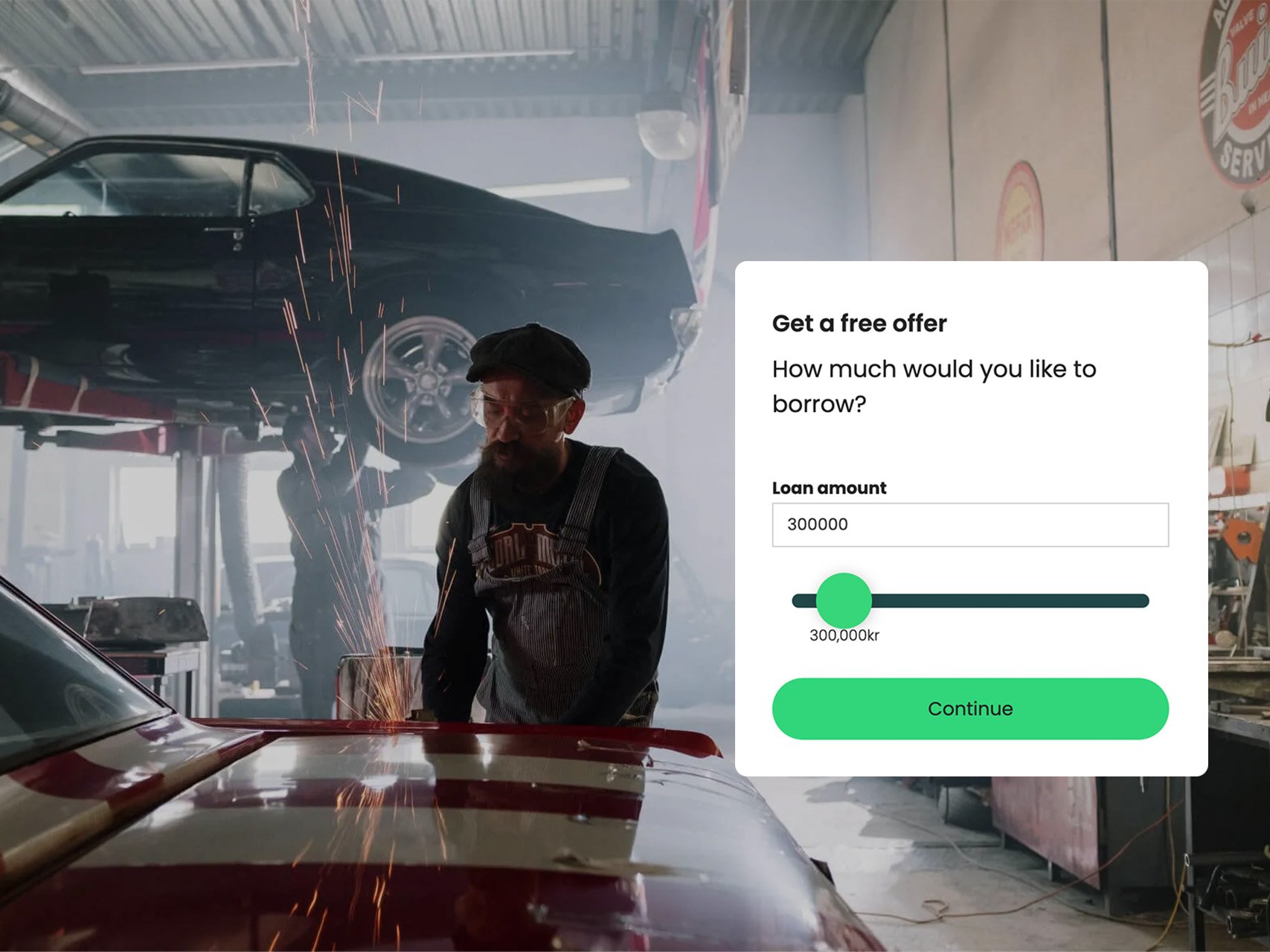

seamless Onboarding & Screening

Create a frictionless digital onboarding that meets all legal requirements, reduces drop-offs, delivers a positive customer experience – and reduces your risk.

Data:

Proactive & automated monitoring

Detect unusual events and elevated risks in real time. Focus your resources on customers who actually pose a risk, and automate the monitoring on the rest,

Data:

Flexible Setup – Built Around Your Workflow

See how we solve your most common challenges with smooth, automated flows.

API Platform & Webhooks

For product teams building digital onboarding, credit checks, or compliance systems. Seamlessly integrate data for instant, automated decisions and a top-tier customer experience.

Lookup

For compliance teams, advisors, and AML investigators needing to deep-dive into complex cases. A powerful tool to investigate and document without IT support.

Web Monitoring

For AML managers and Compliance Officers, this solution ensures proactive, efficient AML compliance by alerting you to risk changes across your customer base.

See How We've Helped Our Customers Grow Their Business

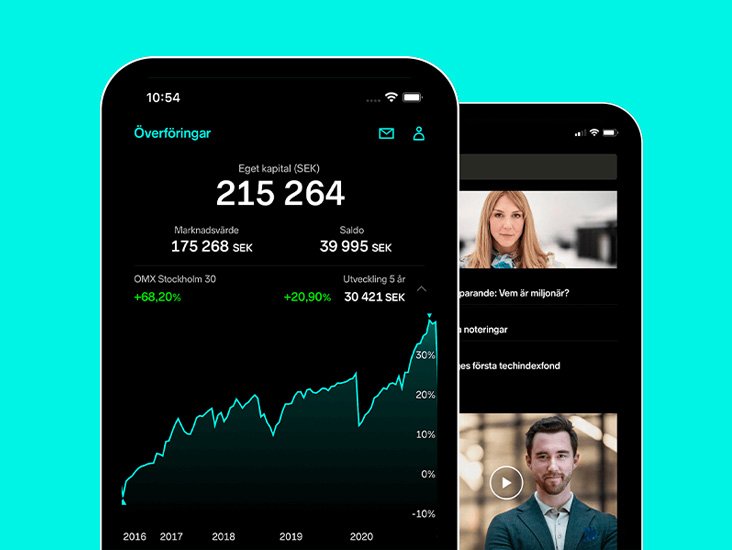

+50% conversion through automated onboarding

How We Helped Qred Automate Their Credit Assessment

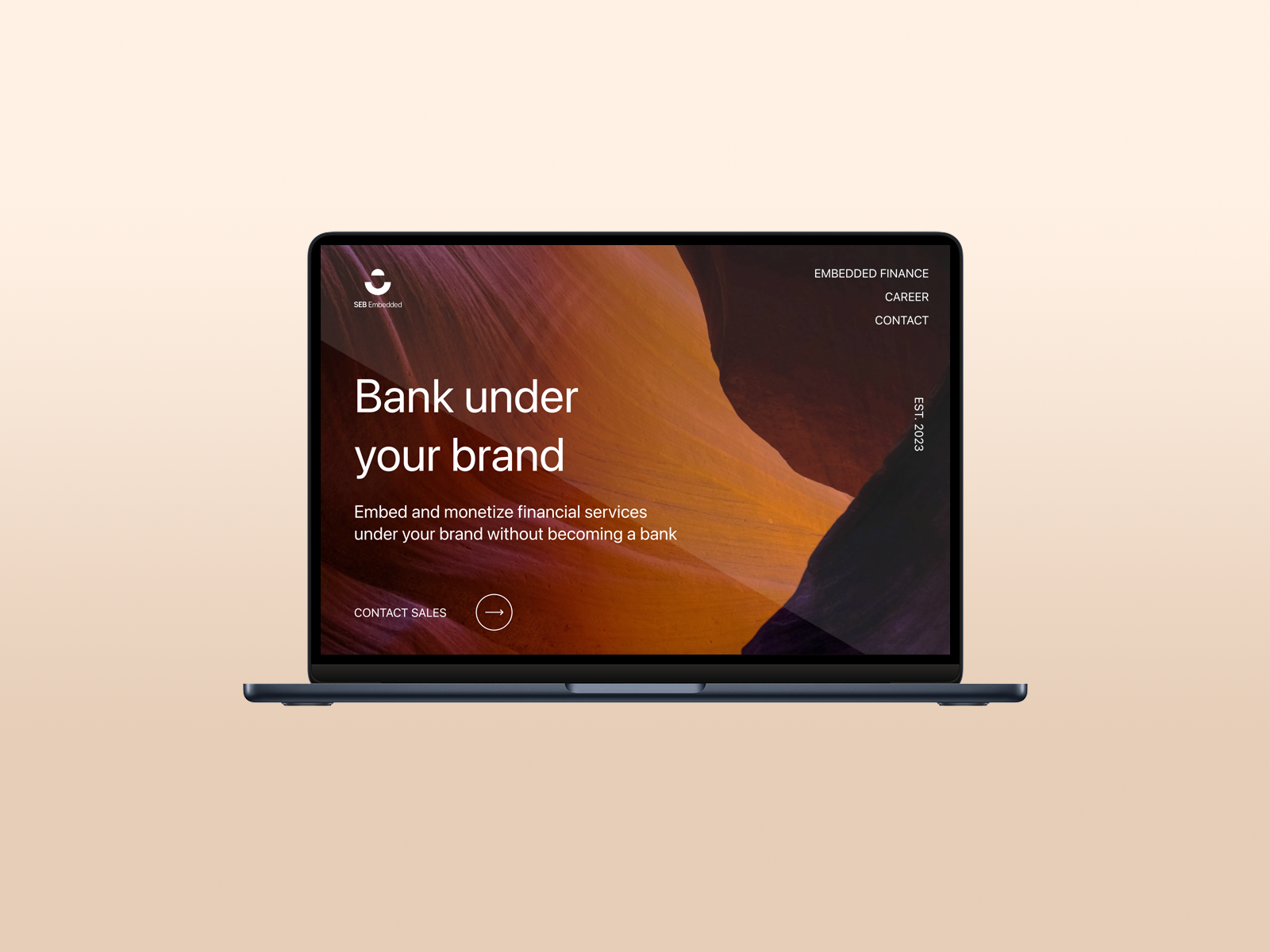

See How SEB Accelerated Their Time-To-Market With Our Help.

Financial Innovation with SEB Embedded & Roaring

”Banking-as-a-service is a fascinating space developing really quickly right now. For us, it is about leveraging our strengths as a full-service bank, building new technology around it. But it is also about finding the right partners to help build great products and services. Our experience is that Roaring is a great partner in the area of data collection and real-time subscription.”

- Christoffer Malmer, Head of SEB Embedded

Read full Customer Story.

Want to See Roaring in Action?

Book a quick walkthrough and discover how to scale your compliance workflows.

Frequently Asked Questions

-

We source our information from reliable, official channels such as government agencies and public registers. You can count on most of our services being updated daily, so you always have the latest insights.

-

Roaring provides access to company and person data across the Nordics – Sweden, Norway, Denmark, and Finland – as well as in Spain. We also offer global services such as PEP and sanction list checks, and access to international bank information.

-

No problem! If a dataset needs authorization, we'll assist you every step of the way. We'll guide you through the application process and handle communication with the relevant authorities, letting you concentrate on your core business.

-

We offer two convenient monitoring options: integrate directly with your systems using webhooks, or use our intuitive interface. Both allow you to track companies and individuals and receive daily updates on any changes.

-

Our risk assessment tools are based on models from the Swedish Economic Crime Authority. You can receive clear risk reports that highlight potential risks associated with individuals or companies.

The Right Data for Smarter Compliance

Streamline your business processes and reduce risk with real-time access to critical data.